SmartAsset Advisors, LLC (“SmartAsset”), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. In Chart 3, we look at all the stocks in the S&P 500 and compute the high/low range for each ticker each day. The chart shows the average for each ticker over the same two years we are analyzing above, plotted as turquoise lines in the chart. The box and whisker chart shows the median stock has over 2.7% range (where the grey boxes touch), with more than 75% of the stocks averaging a daily range of 2.35% (from the bottom of the darker grey box up).

When a Limit State occurs, the SIPs indicate the National Best Bid (Offer) as a Limit State Quotation. Trading exits a Limit State if, within 15 seconds of entering the Limit State, all Limit https://forex-review.net/ State Quotations are executed or canceled in their entirety. If the market does not exit a Limit State within 15 seconds, the primary listing exchange declares a five-minute Trading Pause.

It’s worth noting that stock halts can turn ugly pretty quickly. It will also depend on the type of information released by the company. Circuit breakers are in place to prevent additional market volatility. If Level 1 and 2 are breached, trading is halted for a minimum of 15 minutes. If level 3 is breached, trading is halted for the remainder of the day.

When markets make major moves during a very short time period, this can cause the contract price to reach its limit down (or limit up) for a few days before making its way toward matching the market’s price again. A trading halt starts at 15 seconds and may be extended to five minutes. If the conditions that caused the halt aren’t relieved, the halt may be extended again. Limit Up-Limit Down is a volatility control measure approved by the Securities and Exchange Commission as a pilot program in 2012. The rule was a reaction to the exceptional market volatility that accompanied the 2008 financial crisis. In the real world, ETFs are significantly less volatile than single stocks, thanks to the diversification of the underlying portfolio, which lowers risk.

- A stock can be halted to allow vital news information to be disseminated by traders and investors that may have a significant impact on the price of the stock.

- Oilers coach Todd McLellan challenged the play but lost that challenge.

- Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles.

Comments may take up to an hour for moderation before appearing on the site. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings. Does anyone doubt a fierce competitor like Perry would bend the rules as much as he could?

When a stock is halted your broker will reject orders and cancel any limit orders you may have in place. Orders will be accepted once the stock opens back up for trading. On the play Ryan Getzlaf of the Duck whips the puck on net as Perry broker liteforex goes to screen Oilers goalie Cam Talbot. Perry bashes into him skate-to-skate and also runs into his stick and blocker. It’s a clear case of goalie interference, the kind Zach Hyman gets called on every twentieth game or so it would seem.

Limit down, and the entire Limit Up-Limit Down rule, applies to any National Market Systems (NMS) stock, which includes the majority of stocks listed on an exchange. This can include nonconvertible and convertible preferred stock. However, the data shows the same result holds for more concentrated ETFs. For example, the SOXQ ETF, which holds semiconductor stocks, averages wider ranges each day than SPY, at over 1.75%, but the stocks in its portfolio also still see larger ranges of returns on an average day, with the median stock seeing 3.4%, still almost double. In fact, it’s almost not possible to see the tier 1 ETPs on normal dates – as there were only 68 in the whole period (excluding MWCB dates).

Resumption of Trading for Paused or Halted LULD Securities

It is also interesting to see what stocks trigger LULDs the most. We’re dedicated to giving you the very best in investing education with a focus on detailed guides in complex financial topics, trading, economics and personal finance.

Limit Up-Limit Down: Investing Guide

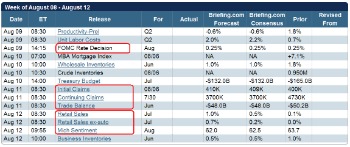

Exchanges reserve the right to take the necessary measure to prevent panic selling by invoking Rule 48 and halting trading when the overall stock market has experienced an aggressive downfall. Below are some of the different circuit breaker thresholds on the S&P500, relative to the previous day’s closing price. If a market maker bids $21 at 10 a.m., this is 10% more than the last trade price so it triggers the Limit Up-Limit Down.

FINRA Utility Menu

Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. However, we also need to ensure that doesn’t lead to unnecessary ETF LULD halts – that might remove critical liquidity and hedging tools from market makers just as a genuine correction occurs – in turn making a MWCB even more likely to trigger. The data shows that ETFs should have lower volatility than the stocks they hold.

Company

If the market maker cancels the flagged quote during that time, trading resumes after 15 seconds. FINRA has created the following charts to assist members in identifying the types of transactions that qualify for this exclusion and properly coding when reporting the transactions to FINRA. The majority of the time trading is halted directly by the exchanges. In unique cases, the SEC can halt trading for specific security if there is a pending investigation. In case you want some more information, we have a guide that explains how stock trading halts work.

Customer options orders received by Wells Fargo Advisors are routed to other market centers and exchanges for handling and execution. Although options are not subject to the Limit Up-Limit Down (“LULD”) rules, market centers and exchanges will generally halt trading in options when the underlying security is halted or paused in response to LULD. In the event of such trading halts, Wells Fargo Advisors will continue to accept and route customer options orders. Options market centers and exchanges may reject certain orders, including new “market” orders entered when the underlying security is in a “Limit” or “Straddle” state. Limit Up-Limit Down stops trades from taking place outside a specific range, either up or down, from the average trading price during the previous five minutes. It does this by halting trading in a stock or other security when a bid or offer price touches the upper or lower edges of the band.

Which stocks see LULDs trigger most?

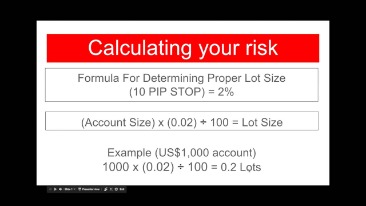

Both limits down and limits up actively prevent trades in NMS securities from occurring outside of the previously mentioned price bands. Generally, in either direction, the limit is set as a percentage of the market price of the securities at hand. The price band of a stock is based on a certain percentage level both above and below the average price of the stock over the immediately preceding five-minute trading period. The Limit Up-Limit Down plan was filed by FINRA [3] along with other financial organizations and was designed to help address sudden price movement in equities.

If we look at the past two years (2020 & 2021), we see that LULDs don’t usually trigger that often at all, especially considering there are around 10,000 NMS securities in the market trading all day, every day. We were mad at the refs and the NHL, of course, but also enraged at Ducks players like Perry, Ryan Getzlaf, Ryan Kesler, Josh Manson and Kevin Bieksa. If there are no limits down or up, there is a chance that a futures contract’s price will surge or drop to an irrational value simply because of market panic.

Asif first frequented the Shack when it was sCary’s Shugashack to find all things Quake. When he is not immersed in investments or gaming he is a purveyor of fine electronic music. That was impressive work by Friedman, as it’s not easy to change the minds of folks when they have adopted a narrative.